U.S. Treasury Secretary Scott Bessent has said President Donald Trump’s suggestion of companies reporting on a semiannual basis would be good news for investors.

Trump proposed scrapping quarterly earnings reports in a Truth Social post on Monday, saying it would allow company executives to focus on long-term goals rather than fixate on short-term metrics.

“President Trump realizes that whether it’s the U.K., [or] it is the U.S., our public markets are atrophying, and this might be one way to bring back and cut costs for public companies without harming investors,” Bessent told CNBC in London Tuesday.

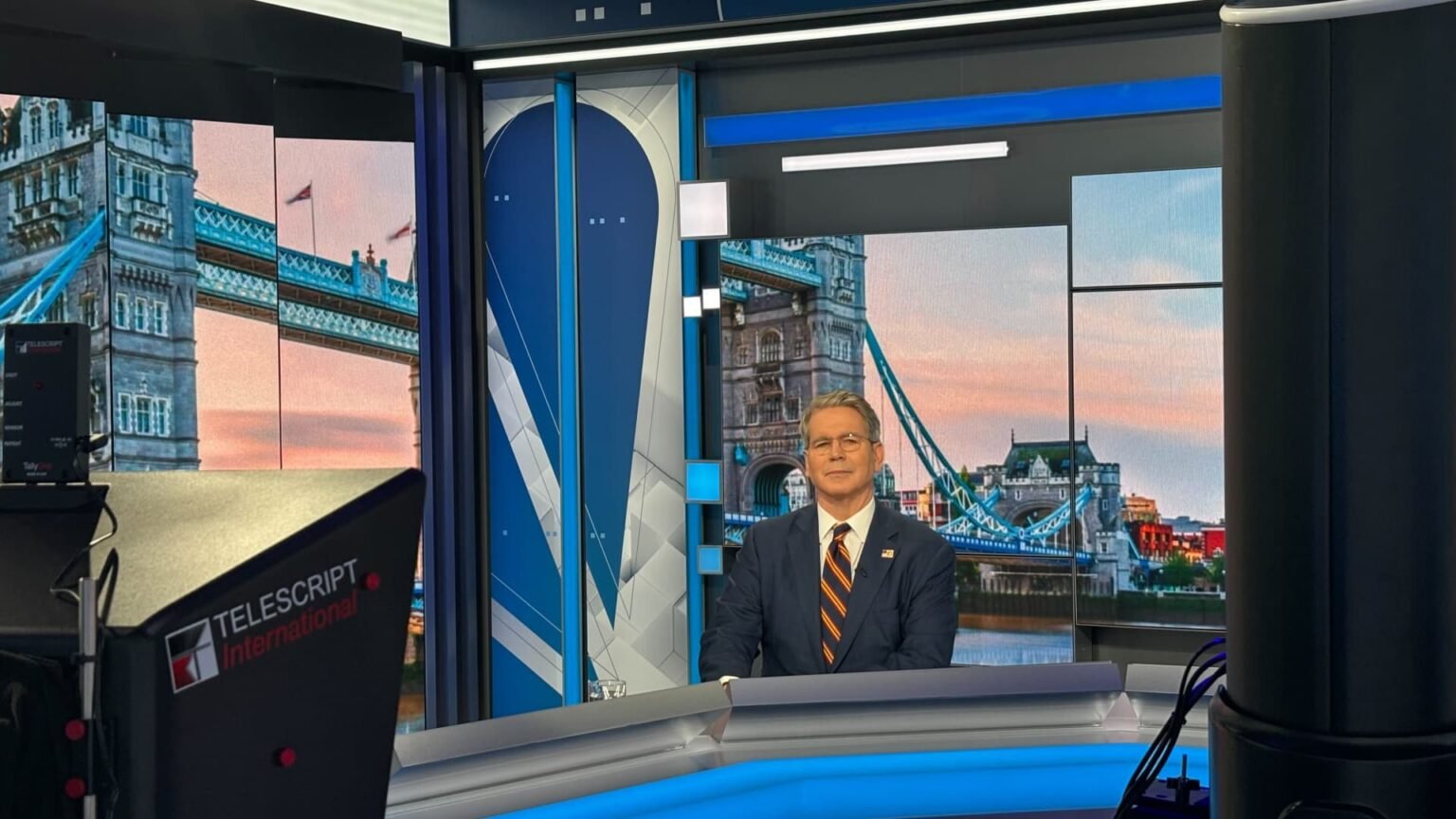

U.S. Treasury Secretary Scott Bessent at CNBC studios in London.

U.S. Treasury Secretary Scott Bessent at CNBC studios in London.

It comes as many companies choose to remain privately held, rather than list publicly, partly due to increased scrutiny and compliance costs each quarter. The number of publicly listed companies in the U.S. has fallen from more than 7,000 in 1996 to less than 4,000 in 2020.

Trump also suggested that scrapping quarterly reports would bring the U.S. in line with many foreign jurisdictions that already follow a semiannual reporting regime.

“Did you ever hear the statement that, ‘China has a 50 to 100 year view on management of a company, whereas we run our companies on a quarterly basis??? Not good!!!'” Trump said.

Whilst companies listed in China report every quarter, stocks on the Hong Kong exchange are subject to reporting every six months.

In the U.K. and European Union, companies also report semiannually, but can issue quarterly reports if they choose.

However, some investors have previously warned that quarterly earnings reports help protect their interests by making companies’ finances more transparent and regular.

The Council of Institutional Investors (CII), a group that represents pension funds invested in stocks, has suggested that a lack of quarterly reporting may not “sufficiently” protect investors.

Foreign companies listed in the United States under the foreign private issuer scheme, like Arm and Spotify, are also exempt from having to report quarterly, but some voluntarily report quarterly.

CII has said that many of the exemptions foreign companies enjoy in the U.S. currently may “undercut” effective corporate governance.

Could it make the U.S. more attractive?

European exchanges have seen a number of high-profile companies leaving their home markets to list in the U.S. over the past decade, attracted by the higher valuation levels achieved by their American peers, along with some regulatory benefits.

A move away from quarterly reporting could make the U.S. market even more attractive to European companies as it would lower compliance costs for those considering the move.

“I don’t think that this is a game-changing development if it were to be implemented, but it will definitely come into the mix of considerations for a company thinking about if and how they want to list in the U.S,” said Mike Bienenfeld, a lawyer specializing in SEC compliance at law firm Linklaters.

When asked whether the move would make the U.S. an even more attractive destination for European companies, the Treasury Secretary said: “It’s tough being popular.”